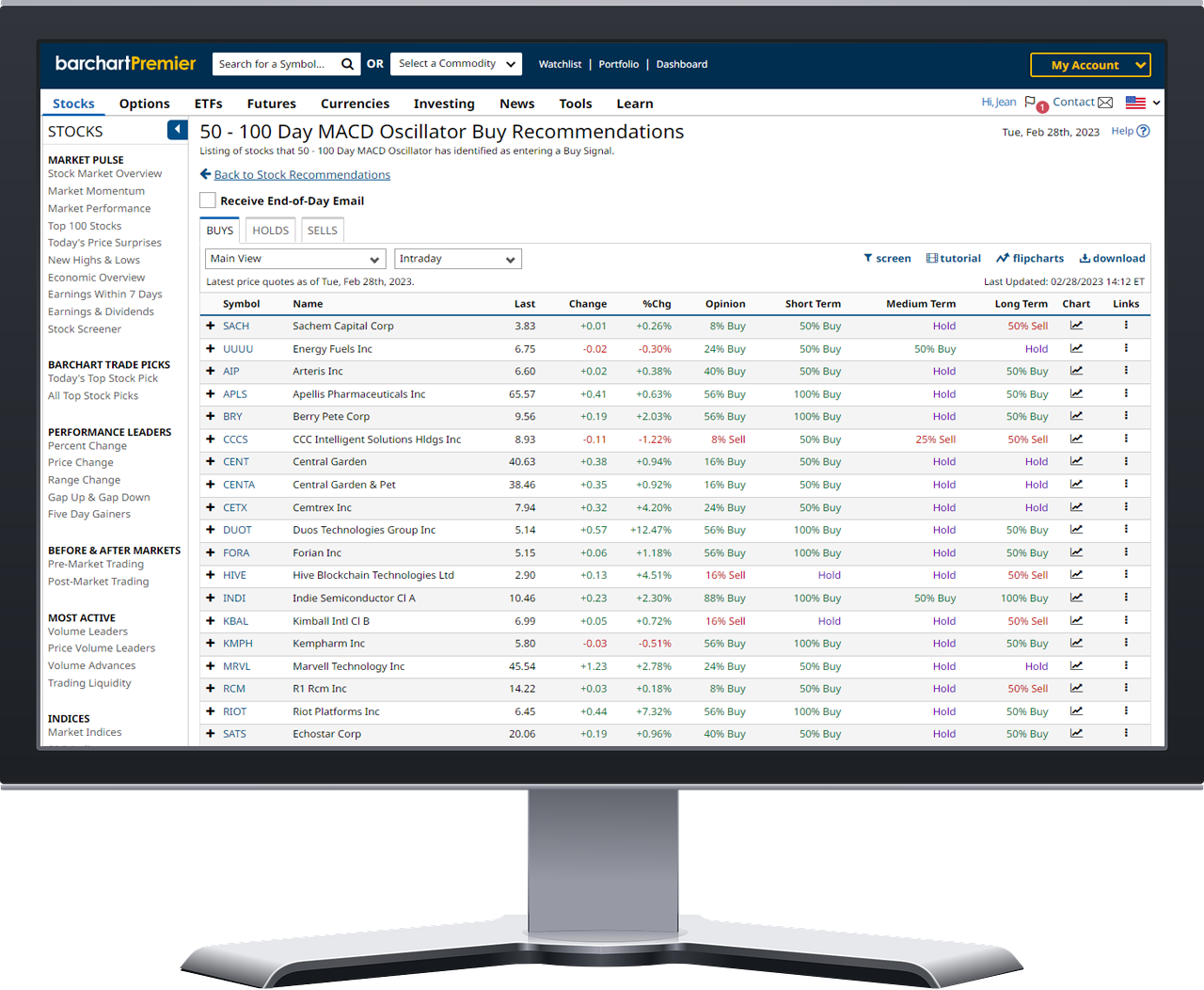

TrendSpotter Buy Recommendations

Studies noted with * are available only in Snapshot Charts and those noted with ^ are available only in Interactive Charts.

Technical Indicators

The descriptions, formulas, and parameters shown below apply to both Interactive Charts and Snapshot Charts, unless noted. Please note that some of the parameters may be slightly different between the two versions of charts.

Studies noted with * are available only in Snapshot Charts and those noted with ^ are available only in Interactive Charts.

- Accumulation/Distribution Williams ^

- Alligator ^

- Anchored VWAP ^

- Aroon Oscillator

- Aroon Up/Down

- Average Directional Index

- Average Directional Index Modified

- Average True Range

- Average True Range Adjusted ^

- Average True Range Percent ^

- Awesome Oscillator ^

- Bollinger Bands®

- Bollinger Bands %B ^

- Bollinger Bands Squeeze ^

- Bollinger Width

- Camarilla Pivot Points ^

- Candlesticks

- Candlesticks – Hollow

- Cash Overlay ^

- Chaikin Accumulation Distribution

- Chaikin Money Flow

- Chaikin Oscillator

- Chaikin Volatility

- Chande Momentum Oscillator ^

- Change Over True Range ^

- Close Location Value

- Colored OHLC Bars ^

- Commitment of Traders

- Commitment of Traders Disaggregated

- Commitment of Traders Financial

- Commodity Channel Index

- Comparative Relative Strength ^

- Coppock Curve ^

- Dashed Line

- Derivative Oscillator ^

- Detrended Price Oscillator ^

- Distance From Average ^

- Donchian Channel

- Donchian Width

- Dorsey Relative Strength ^

- Ease of Movement

- Elder Impulse System ^

- Elder Ray (Bear & Bull Power)

- Force Index ^

- Guppy Multiple Moving Average ^

- Heikin-Ashi ^

- Heikin-Ashi Smoothed ^

- Highest High/Lowest Low ^

- HLC Bars ^

- Historical Volatility ^

- Hull Moving Average ^

- Ichimoku Cloud ^

- Implied Volatility

- Keltner Bands ^

- Keltner Channel

- Keltner Channel Exponential ^

- Know Sure Thing ^

- Line

- Linear Regression Channel ^

- MACD Oscillator

- MACD Oscillator Exponential

- Mansfield Relative Strength ^

- Mass Index

- McGinley Dynamic ^

- McClellan Oscillator ^

- Momentum

- Money Flow Index

- Moving Average

- Moving Average Envelope ^

- Moving Average Envelope Exponential ^

- Moving Average Envelope Smoothed ^

- Moving Average Exponential

- Moving Average Exponential 2X ^

- Moving Average Exponential 3X ^

- Moving Average High/Low

- Moving Average Ribbon ^

- Moving Average Smoothed ^

- Moving Average Triangular

- Moving Average Weighted

- Moving Linear Regression ^

- Moving Standard Deviation

- Negative Volume Index

- On Balance Volume

- Open Interest

- Oscillator ^

- Parabolic Time/Price

- Percent Change ^

- Percent R

- Percentage Price Oscillator

- Percentage Volume Oscillator

- Pivot Points ^

- Pivot Points Bands ^

- Plot Line *

- Positive Volume Index

- Price Envelope *

- Price Momentum Oscillator

- Price Performance

- Price Volume Trend

- Price Range *

- Rate of Change

- Relative Strength Index

- Relative Strength index Modified ^

- Relative Volume

- Retracement ATR High / Low ^

- Schaff Trend Cycle ^

- Stochastic, Fast

- Stochastic, Slow

- Stochastic, Modified ^

- Stochastic, RSI

- Stochastic Momentum Index ^

- Supertrend ^

- Trend Seeker®

- Triple Exponential

- True Strength Index ^

- TTM Squeeze

- Turtle Channel ^

- Turtle Channel Retracement ^

- Typical Price ^

- Volatility Stop ^

- Volume

- Volume at Closing Price ^

- Volume Moving Average ^

- Volume Oscillator ^

- VWAP (Volume Weighted Average Price) ^

- Vortex Indicator ^

- Weighted Alpha ^

- Weighted Close ^

- Welles Widler Volatility ^

- Wilder Accumulative Swing Index ^

- Accumulation/Distribution Williams ^

- Alligator ^

- Anchored VWAP ^

- Aroon Oscillator

- Aroon Up/Down

- Average Directional Index

- Average Directional Index Modified

- Average True Range

- Average True Range Adjusted ^

- Average True Range Percent ^

- Awesome Oscillator ^

- Bollinger Bands®

- Bollinger Bands %B ^

- Bollinger Bands Squeeze ^

- Bollinger Width

- Camarilla Pivot Points ^

- Candlesticks

- Candlesticks – Hollow

- Cash Overlay ^

- Chaikin Accumulation Distribution

- Chaikin Money Flow

- Chaikin Oscillator

- Chaikin Volatility

- Chande Momentum Oscillator ^

- Change Over True Range ^

- Close Location Value

- Colored OHLC Bars ^

- Commitment of Traders

- Commitment of Traders Disaggregated

- Commitment of Traders Financial

- Commodity Channel Index

- Comparative Relative Strength ^

- Coppock Curve ^

- Dashed Line

- Derivative Oscillator ^

- Detrended Price Oscillator ^

- Distance From Average ^

- Donchian Channel

- Donchian Width

- Dorsey Relative Strength ^

- Ease of Movement

- Elder Impulse System ^

- Elder Ray (Bear & Bull Power)

- Force Index ^

- Guppy Multiple Moving Average ^

- Heikin-Ashi ^

- Heikin-Ashi Smoothed ^

- Highest High/Lowest Low ^

- HLC Bars ^

- Historical Volatility ^

- Hull Moving Average ^

- Ichimoku Cloud ^

- Implied Volatility

- Keltner Bands ^

- Keltner Channel

- Keltner Channel Exponential ^

- Know Sure Thing ^

- Line

- Linear Regression Channel ^

- MACD Oscillator

- MACD Oscillator Exponential

- Mansfield Relative Strength ^

- Mass Index

- McGinley Dynamic ^

- McClellan Oscillator ^

- Momentum

- Money Flow Index

- Moving Average

- Moving Average Envelope ^

- Moving Average Envelope Exponential ^

- Moving Average Envelope Smoothed ^

- Moving Average Exponential

- Moving Average Exponential 2X ^

- Moving Average Exponential 3X ^

- Moving Average High/Low

- Moving Average Ribbon ^

- Moving Average Smoothed ^

- Moving Average Triangular

- Moving Average Weighted

- Moving Linear Regression ^

- Moving Standard Deviation

- Negative Volume Index

- On Balance Volume

- Open Interest

- Oscillator ^

- Parabolic Time/Price

- Percent Change ^

- Percent R

- Percentage Price Oscillator

- Percentage Volume Oscillator

- Pivot Points ^

- Pivot Points Bands ^

- Plot Line *

- Positive Volume Index

- Price Envelope *

- Price Momentum Oscillator

- Price Performance

- Price Volume Trend

- Price Range *

- Rate of Change

- Relative Strength Index

- Relative Strength index Modified ^

- Relative Volume

- Retracement ATR High / Low ^

- Schaff Trend Cycle ^

- Stochastic, Fast

- Stochastic, Slow

- Stochastic, Modified ^

- Stochastic, RSI

- Stochastic Momentum Index ^

- Supertrend ^

- Trend Seeker®

- Triple Exponential

- True Strength Index ^

- TTM Squeeze

- Turtle Channel ^

- Turtle Channel Retracement ^

- Typical Price ^

- Volatility Stop ^

- Volume

- Volume at Closing Price ^

- Volume Moving Average ^

- Volume Oscillator ^

- VWAP (Volume Weighted Average Price) ^

- Vortex Indicator ^

- Weighted Alpha ^

- Weighted Close ^

- Welles Widler Volatility ^

- Wilder Accumulative Swing Index ^

TrendSpotter Buy Recommendations

Looking for new trading ideas to jump-start each day? For less than $10 a month, you can, with a Barchart Plus Membership.

Every day, Barchart provides details on Stocks, ETFs, Futures, and Forex whose signals indicate a New Buy, Sell, or Hold for any of the 13 indicators that make up the Barchart Overall Opinion. These pages are invaluable tools to give you new trading ideas for symbols that are entering a new trend.

The 13 indicators show traders what a variety of popular trading systems are suggesting in terms of going long or short the market.

Stocks: 15 20 minute delay (Cboe BZX is real-time), ET. Volume reflects consolidated markets. Futures and Forex: 10 or 15 minute delay, CT. Market Data powered by Barchart Solutions. Fundamental data provided by Zacks and Morningstar.

Barchart is committed to ensuring digital accessibility for individuals with disabilities. We encourage users to Contact Us for feedback and accommodation requests.

© 2023 Barchart.com, Inc. All Rights Reserved.

The Indicator page shows you all stocks that have triggered new Buy, Sell, or Hold signals for that specific strategy. Clicking on the “Chart” icon opens a chart for the symbol with the indicator plotted, so you can see the symbol’s price movement and how it triggered the Buy, Sell or Hold signal relative to the indicator. The “P&L” icon will show the performance and profit/loss summary of this trading strategy over the past 5-years .

Barchart Premier Members may also opt-in to receive an End-of-Day Email report of the top 10 symbols found on this Trading Signals page. The End-of-Day Email digests are sent at 5:30 PM CT, Monday through Friday.

Note: Opinions on each symbol are updated every 20 minutes throughout the day, using delayed data from the exchanges. A security needs to have at least 201 active trading days in order to generate an Opinion reading.

For all markets: To be included in the Signals Upgrade or Downgrade page, the stock must have traded today, with a current price between $2 and $10,000 and with a 20-Day average volume greater than 1,000. A Stock must have an Opinion and a last month’s Opinion.

For the U.S. market, a stock must be listed on the NYSE, NYSE Arca or Nasdaq exchange, excluding ETFs, unit investment trusts, closed end funds, warrant stocks, preferred securities and any non-SIC classified stock. OTC-US stocks have to be trading above $0.25 and have a (daily volume * last price) above 10,000. For the Canadian market: a stock must be listed on the TSX exchange, excluding unit investment trusts, closed end funds, warrant stocks, preferred securities and any non-SIC classified stock.

Available only with a Barchart Plus or Premier Membership, you can base a Stock Screener off the symbols currently on the page. This lets you add additional filters to further narrow down the list of candidates.

- Click “Screen” on the page and the Stock Screener opens, pulling in the symbols from the Opinions page.

- Add additional criteria in the Screener, such as “20-Day Moving Average is greater than the Last Price”.

- View the results and save them to a Watchlist, or save the Screener to run again at a later date.

- Running a Saved Screener at a later date will always present a new list of results. Your Saved Screener will always start with the most current set of symbols found on the Opinions page before applying your custom filters and displaying new results.